SOLUTIONS

The Power of Advanced Predictive AI Solutions for Alpha Generation

WHY AXYON AI - KEY BENEFITS

The AI-powered solutions we offer are just the tip of the iceberg.

Beneath the surface of real AI-based solutions lies years of technical development, AI research and a robust tool that can transform every facet of your predictive analytics and investment strategies.

EFFICIENCY Our expertise and AI-based solutions are designed to integrate seamlessly with your existing systems, enabling a smooth and swift transition. You can bypass a lengthy and costly process and be live with a cutting-edge solution in just 2 months

ADVANTAGE You can use our predictive AI insights to generate new investment ideas. No longer need to rely only on traditional techniques to identify complex market patterns beyond human logic

OUR SOLUTIONS

COMPASS

AI-generated alerts to stay informed about market developments, emerging trends and potential risks that complement quant analysis

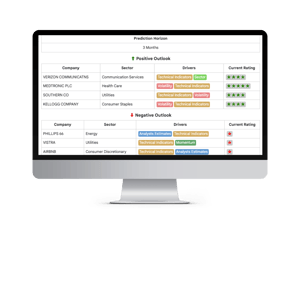

SIGNALS

AI-based assets performance signals that identify under and outperformers within a given investment universe & time horizon

STRATEGIES

Off-the-shelf and bespoke AI-powered model strategies and indices on several asset classes and investment universes

WHY SHOULD I USE PILLAR PAGES?

- Lorem ipsum dolor amet, consetetur sadipscing

- Invidunt ut labore et dolore magna aliquyam erat

- Accusam et justo duo dolores et ea rebum. Stet

- Sanctus est Lorem ipsum dolor sit amet.

- Lorem ipsum dolor sit amet, consetetur sadipscing

- Invidunt ut labore et dolore magna aliquyam erat,

- Accusam et justo duo dolores et ea rebum. Stet

- Sanctus est Lorem ipsum dolor sit amet.

GOOGLES SEARCH ALGORITHM HAS CHANGED

Find out what you need to consider building a search engine optimized websiteCLIENTS

We are trusted by clients worldwide to deliver the most advanced AI solutions for alpha generation, such as:

ASSET MANAGERS

HEDGE FUNDS

FINANCIAL SERVICES SOFTWARE PLATFORMS

PRIVATE BANKS

CLIENTS THAT TRUST US

BUSINESS CASES

Learn what our customers have achieved so far with Axyon AI solutions.

.jpg?width=300&name=headofinvest%20(2).jpg)

Delivered 500+ bps overperformance in 2022 for a large wealth manager implementing Axyon AI’s Eurostoxx50 asset selection on an equity fund’s sleeve

Read More

Fund powered by Axyon AI European Equity Indices strategy ended 2022 as the best performing Quant vehicle for a large European Asset Management firm

Read More

An innovative mid-sized bank's wealth management embraced Axyon AI's stock-picking tech to develop European equity products for diverse customer segments.

Read More

Provided our customer with equity/fixed income, FX and multi-asset overlays since 2018, with more than $300M under technology

Read MoreHOW WE WORK

Understanding that AI adoption may appear daunting, our implementation process is based on comprehensive training and support.

Knowing every client has a different investment strategy and investment needs, this is what an implementation process can look like when working with Axyon AI:

STEP 1

STEP 2

STEP 3

STEP 4

STEP 5

(Eg: e-mail, SFTP or Web App)

OUR PARTNERS

.png?width=300&name=UNIMORE%20(1).png)

.png?width=300&name=UNIBO%20(1).png)